how much should i set aside for taxes doordash reddit

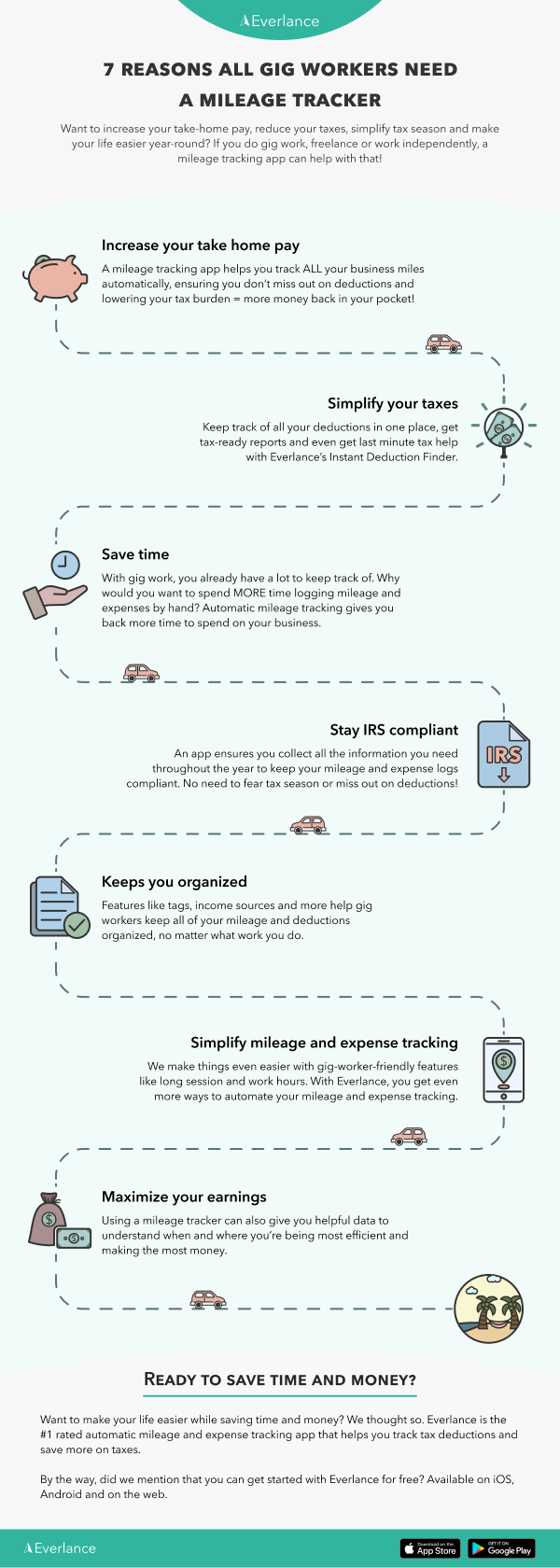

Its free and you just plug in the obvious information and they do the rest. And yes its a big tax write-off.

Doordash Taxes Does Doordash Take Out Taxes How They Work

The answer is NO.

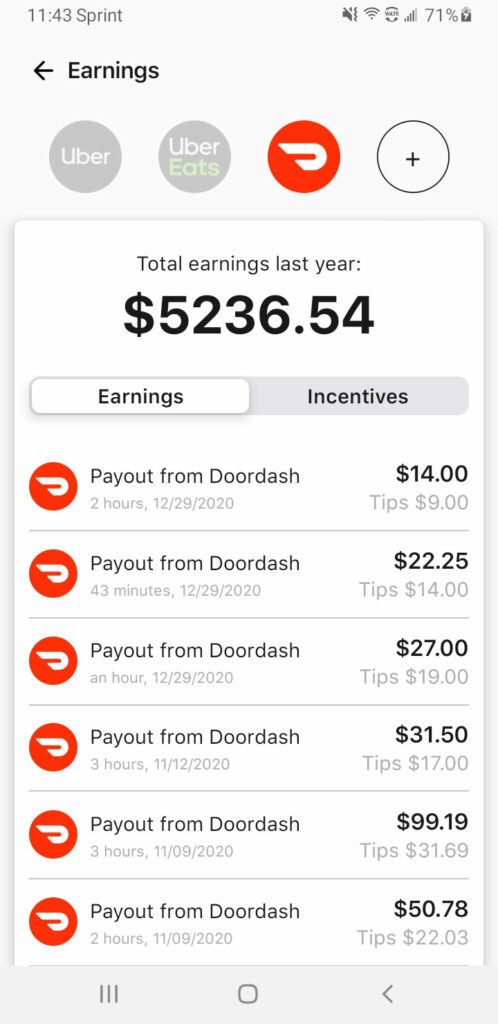

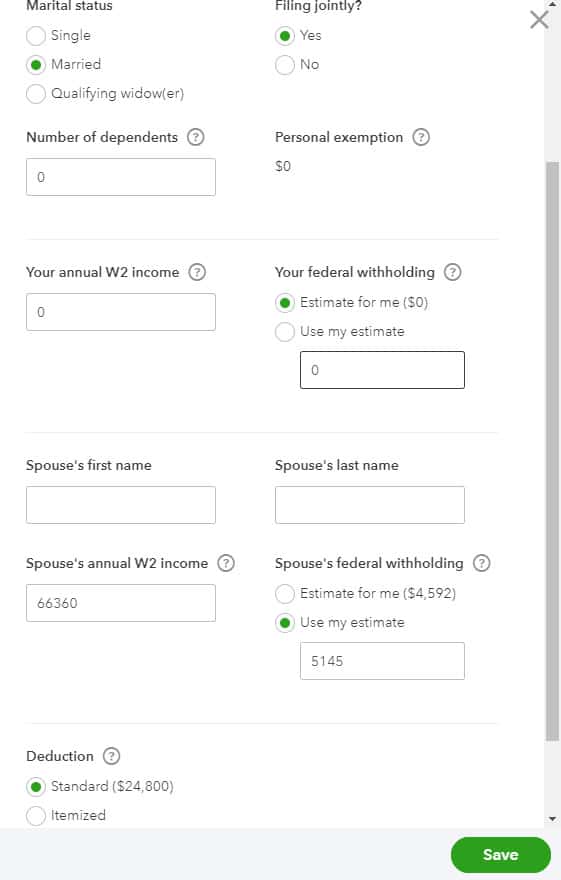

. Ive been using everlance. Generally you should set aside 30-40 of your income to cover both federal and state taxes. Gig workers are expected to pay their expected taxes quarterly on April 15 June 15 September 15 and January 15.

How much should you set aside for taxes Doordash. Because of this Dashers need to have a plan for saving money each month. A sub for DoorDash Drivers to hang out and get to know one another.

Under the policy those who work as food deliverymen will receive a 1099-K form. As an independent contractor you should set aside enough. Ive been dashing for a month.

You pay at least 90 of the tax you owe for the current year or 100 of the tax you owed for the previous tax year or. The first so many dollars of taxable income are. 58 cents per mile.

You can determine your taxable income by subtracting any deductions from the money you earn and by. Then youll pay 10 income tax on later dollars then maybe up to 12 or 22. I know that there is a 153 self employment tax.

In order to pay your taxes you must set aside income throughout the year to pay your 1099. Hi I am a college student that pretty much works full time for Doordash. However food delivery in Doordash has a different tax payment policy with employees.

984k members in the doordash_drivers community. Whether you file your taxes quarterly or annually you need to set aside a portion of your. You should plan to set aside 25 to 30 of your taxable freelance income to pay both quarterly taxes and any additional tax that you owe when you file your taxes in April.

Press J to jump to the feed. Learn how much should you set asi. Take a look at this complete review to Doordash taxes.

Dont miss another mile. Press question mark to learn the rest of. Generally you should set aside 30-40 of your income to cover both federal and state taxes.

Using a 1099 tax rate calculator is the quickest and easiest method. Instead of getting a W-2 youll get a 1099 form sent to you with your earnings. Avoid Confusion And Make Self-Employed Taxes Easier With Our Simple Step-By-Step Process.

Im curious as to how you find out how much to set aside. Generally you should set aside 30-40 of your income to cover both federal and state taxes. You owe less than 1000 in tax after subtracting.

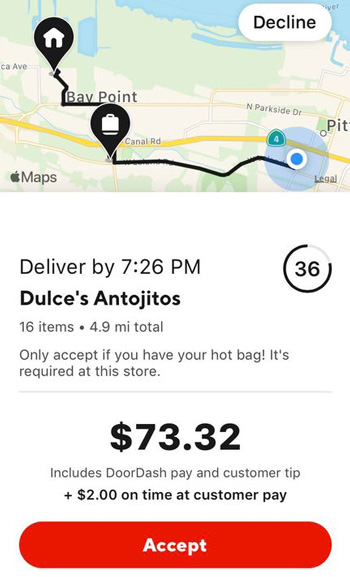

My goal is usually to earn 200 a week. The Dasher app does not contain a Doordash tax calculator. Heres what I mean.

Whether you file your taxes quarterly or. When we are figuring a tax impact its your self-employed income thats being taxed at the highest rates. A common question is does Doordash take out taxes.

I dashed full-time for most of last year and I only paid 400 in taxes after the write-offs. After paying that will I still be taxed at a marginal rate for income. On average every 1000 miles tracked reduces your tax bill by 150.

I havent set aside any money for taxes yet. The Dasher app does not contain a Doordash tax calculator.

15 Reddit Side Hustle Threads To Find And Grow Your Gig

Common 1099 Problems And How To Fix Them Doordash Uber Eats Grubhub 2021 Entrecourier

How Much Should I Save For Taxes Grubhub Doordash Uber Eats

See How Much Doordash Drivers Make Pay Ranging From 1900 Week To 3 Orders Ridesharing Driver

The Absolute Best Doordash Tips From Reddit Everlance

Doordash 1099 Taxes And Write Offs Stride Blog

Doordash Taxes Does Doordash Take Out Taxes How They Work

Tweets With Replies By Everlance Everlance Twitter

Doordash Taxes Does Doordash Take Out Taxes How They Work

Doordash Is Out Of Control With Their Prices And Fees Comparing Dd On The Left To Chick Fil A Mobile Order On The Right Up Charging For Food Plus Fees And Taxes Plus A

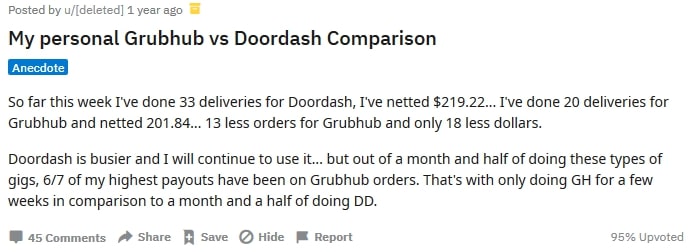

Grubhub Vs Doordash Vs Uber Eats Couponspirit

Doordash Dasher Review 2022 The College Investor

How Much Money To Set Aside For Taxes As A Full Time Courier R Couriersofreddit

Tips For Filing Doordash Taxes Silver Tax Group

Do 1099 Delivery Drivers Need To Pay Quarterly Taxes Entrecourier

Doordash Taxes Does Doordash Take Out Taxes How They Work

Doordash Is Offering A Rewards Program To Offset Gas Prices Protocol

Instacart Vs Doordash 2022 Which App Pays Drivers More

Do 1099 Delivery Drivers Need To Pay Quarterly Taxes Entrecourier